Certifications

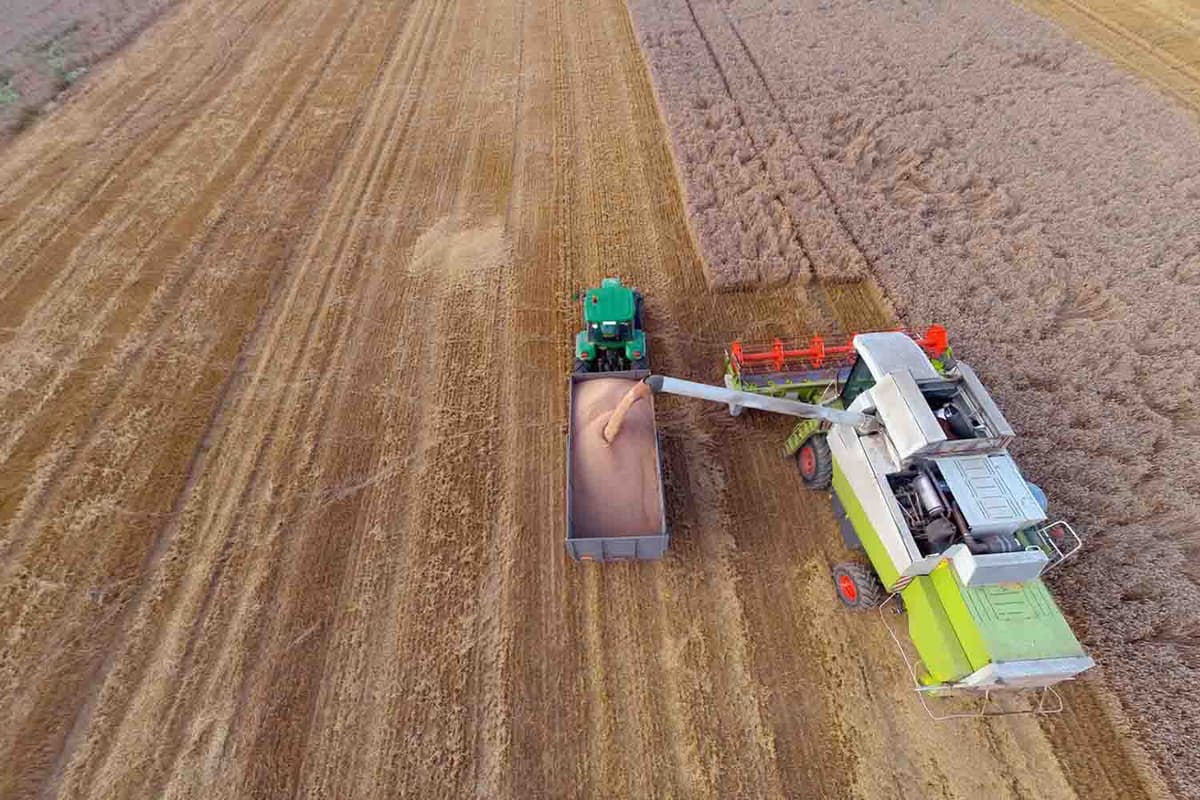

Grow Your Future.

Earn Your Agribusiness and Farm Insurance Specialist Certification

Certifications

Earn Your Agribusiness and Farm Insurance Specialist Certification

The Agribusiness and Farm Insurance Specialist (AFIS®) continuing education program was developed to provide an opportunity for insurance agents, brokers, customer service representatives, and in-house risk managers or insurance buyers to gain specialized expertise in agribusiness and farm insurance and risk management. Completing the AFIS certification will ensure that you understand the most important insurance needs of agribusinesses and farms.

At only $169 per course, you can take all five core courses online and earn the AFIS certification for only $845! Insurance CE Credit is available for $19 more per course.

Continue your studies in the IRMI + WebCE Learning Center.

Share your achievement and provide verification of your specialized knowledge with an IRMI Certification Digital Badge. IRMI has partnered with Credly Acclaim, the largest and most-connected digital credential network with best-in-class security and privacy features. After earning your credentials, you can display your digital badge on your LinkedIn profile, in your email signature, and on a variety of social media and digital platforms.

Credibility

With the AFIS certification behind your name, you make a statement to agriculture and farm professionals that you understand the unique insurance needs of the agribusiness industry and how to meet them.

Convenience

All AFIS core and renewal courses can be completed 100% online at your own pace. IRMI has partnered with WebCE to create the IRMI Learning Center, a user-friendly platform backed by WebCE's award-winning US-based live customer support.

Visibility

Once you earn your certification, you will appear in the IRMI Certification Directory—a powerful online tool that allows insurance buyers or employers to find someone with specialized risk management expertise by certification, location, or name—providing maximum exposure for the credentials you’ve earned.

More Sales

Retail insurance agents and brokers will parlay their increased expertise, confidence, and credibility into more sales to agriculture and farm industry accounts.

Better Coverage

Knowledge gained from the AFIS courses will help you eliminate dangerous coverage gaps and provide better protection for your employer or your clients.

Career Advancement

The specialized knowledge and credibility you gain from the AFIS program will make you a more valuable employee and help you achieve your career goals.

Networking

An AFIS certification provides you access to fellow industry experts through exclusive online communities.

CE Credit

Insurance agents or brokers can simultaneously get convenient state insurance CE credit and an insurance industry certification at a very low cost.

Need another reason to earn your AFIS certification?

Once you earn your certification, you will appear in the IRMI Certification Directory—a powerful online tool that allows insurance buyers or employers to find someone with specialized risk management expertise by certification, location, or name—providing maximum exposure for the credentials you’ve earned.

Take advantage of our reciprocity discount program to earn additional credentials, renew your certification, and save money. Learn how on our FAQ page and start earning multiple certifications today.

The premier conference for insurance and risk management professionals who specialize in the unique exposures and nuanced coverage needs of farms and agribusinesses.