Government Bailout or Catastrophe "Insurance"?

Gary Bausom | November 1, 2006

History reveals a continuous string of catastrophes: earthquakes, floods, tsunamis, volcanoes, and terrorist events. The impact to individuals or businesses has been addressed by insurance/reinsurance and various governments. Regardless of whether citizens had the opportunity to purchase insurance, governments have assisted by filling at least a portion of the gap between coverage or lack thereof and the losses.

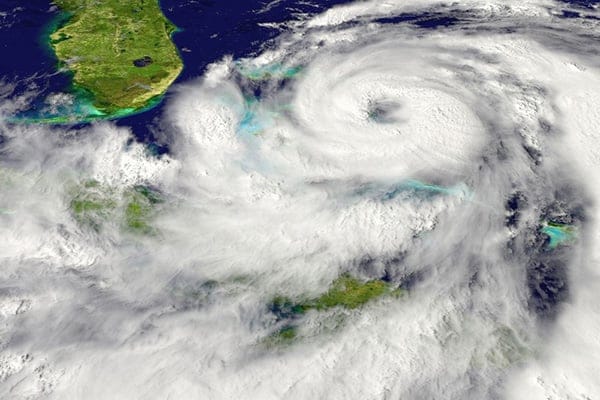

We need to step back and review some recent U.S. catastrophic losses. At this writing, it appears as if the 2006 hurricane season is next to zero. The following figure lists several large U.S. losses from previous years.

FIGURE 1

Losses like these, over the past 10 years, have invoked a response from the federal government along with contributions from states, relief organizations, and private individuals. Hurricanes, for example, have caused some of the largest losses where commercial insurance/reinsurance has paid out significant funds; however, these insurance payments represented approximately 50 percent of the total damages where limits or coverage purchased or available were inadequate to cover sustained losses. Losses for infrastructure are largely self-insured by government.

The Munich Re/Swiss Re's recent reports reflect significant payments by insurance/reinsurance contracts. But the total losses are approximately twice the insurance payments. Where commercial insurance was not purchased or purchased with insufficient limits or scope of coverage, the government has stepped in to help reestablish a geographic area to boost the economy. Beyond human dignity and the general welfare of its citizens, the government is motivated by wanting to get citizens back "on their feet" economically so they can rejoin other members of the tax-paying public.

Government assistance is not limited by geography. A recent example is when fighting broke out in Lebanon in 2006 and U.S. citizens were "trapped." The federal government, including the Navy and the Marines, came to the rescue. The government response was not, "Sorry, catch the next canoe to Greece and then find a flight home on your own." There were few questions, and the government did not take time to see if these were up-to-date tax-paying citizens!

In another example, during the 2004 tsunami in Indonesia, aid poured in from all over the world—governments, relief organizations, corporations, and private citizens—to the tune of $7 billion. The U.S. initially pledged $35 million, quickly increased it to $350 million and President George W. Bush then asked Congress to increase it to $950 million. Total damage from the tsunami is estimated at from $4.5 billion to $5 billion.

In the United States, the government budget for FY 06 calls for approximately: $447 billion for Defense, $33.6 billion for State Department, $49.9 billion for Homeland Security (CIA, Secret Service, Coast Guard, etc.), and $94.6 billion for Agriculture (including protection of food supply). The U.S. Government spends billions on global image (State), security and loss prevention (Homeland Security and Agriculture), and response (Defense). The dollars are budgeted for certain expected line items, but in fact may be spent differently, depending on the unexpected. I doubt any government official questioned how much we had in the budget before the decision was made to bail our citizens out of Lebanon when war broke out.

Hurricane Katrina is a good example of an event that will be paid for by government assistance likely extending over more than 5 years. In government terms, what is $10 billion over 5 or 10 years? It's just "a bump in the road." Deficit spending does not seem to worry too many politicians in Washington for programs with less clarity than a catastrophe in terms of spending.

Terrorism

From a U.S. perspective, there has been a backdrop of financial protection against terrorist acts, provided by the Terrorism Risk Insurance Act (TRIA) of 2002, which the government extended to December 31, 2007. As most insurance professionals know, this protection is focused on terrorist acts within the United States, perpetrated by non-U.S. citizens.

Premiums under TRIA are fairly reasonable for most insureds. However, New York City is an exception due to limited capacity and high premiums. The insurance companies, in a risk-sharing view, have been forced by the federal government to take very large deductibles (multiples of their net and treaty capacity), a function of their written premiums.

The TRIA insuring terms, established by the U.S. Treasury, present a challenge just to maintain a current understanding. Most policyholders will very soon face the question of what to do about terrorism cover when they renew property insurance contracts in 2007. Without a further extension of TRIA, insurance companies are likely to exclude cover for terrorism beyond December 31, 2007, with no obligation to offer terrorism quotes.

So what happens if TRIA is not extended? How much risk is there? How important is a formal TRIA deal? It is likely that it is important to the U.S. government to obtain some contribution from the insurance industry. The large insurance companies, such as AIG, Allianz, Zurich, etc., based on the TRIA formulas, are forced to take a deductible five or six times their net capacity, and they do not have the option of buying adequate reinsurance protection for their net risk retentions.

For an elected official, it is political suicide to be anything less than forthright with funding for a catastrophe. Failure to act decisively and generously would likely number your days in office as determined by the next election or even a possible recall. Additionally, the credibility of your party could be damaged beyond any near-term repair. The further extension of TRIA, beyond December 31, 2007, would appear to reduce the angst for politicians having to make a decision, under fire, at the time of a crisis.

Conclusion

If or when we have a pandemic, a dirty bomb, or a biological attack, no government in the world is going to stand by and tell its citizens that they should have purchased insurance. Obviously, the government response will be in proportion to its existing resources, borrowing capacity, and foreign aid. Catastrophic events will need to be addressed jointly by governments, personal generosity, and perhaps some insurance. The majority of funding in a loss will not likely come from insurance, but from the government.

Opinions expressed in Expert Commentary articles are those of the author and are not necessarily held by the author's employer or IRMI. Expert Commentary articles and other IRMI Online content do not purport to provide legal, accounting, or other professional advice or opinion. If such advice is needed, consult with your attorney, accountant, or other qualified adviser.